Disclosed: The Pay Gap Between CEOs and Employees

http://www.businessweek.com/articles/2013-05-02/disclosed-the-pay-gap-between-ceos-and-employees

Nearly three years after Congress ordered public companies to reveal their

chief executive officer-to-worker pay ratios under the Dodd-Frank law, the

numbers still arenft public. The provision was included to deter excessive

compensation schemes that, in the words of U.S. Senator Robert Menendez

(D-N.J.), gwere part of the fuel that led to the financial collapse.h Since

then, the requirement has been parked at the Securities and Exchange Commission,

which must develop a rule on how to calculate and report the ratio. Questions

remain: Do companies have to determine their median employee compensation by an

actual count or would statistical sampling suffice? How should global companies

reconcile differences in wages and benefits from one country to the next? For

that matter, how should investors interpret differences in compensation across

industries?

Those who oppose publishing this ratio have seized on some of these questions

to argue that the requirement be dropped. gWe donft believe the information

would be material to investors in making investment decisions,h says Tim Bartl,

president of the Center on Executive Compensation, the advocacy arm of a

Washington nonprofit called the HR Policy Association.

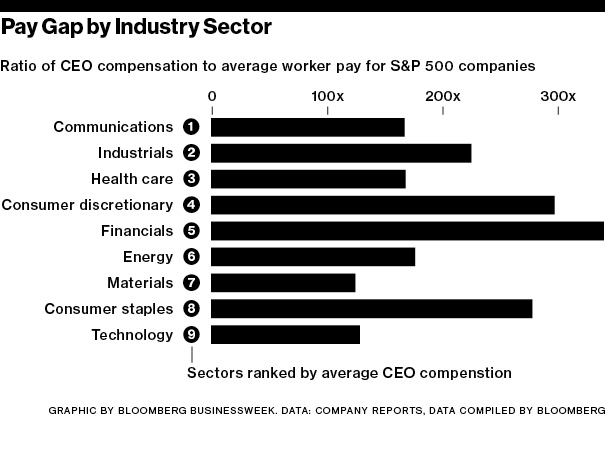

To get a sense of what such ratios could reveal, we conducted an experiment.

It compared the disclosed CEO compensation mandated by the SEC—including salary,

bonus, perks, changes in pension accruals, and the value of stock-based

awards—with U.S. government data on average worker pay and benefits by industry.

(Most companies donft disclose actual payroll information for employees.)

In addition to using the industry-specific averages for workersf

compensation, this ratio differs from what Dodd-Frank requires in at least one

other respect: It compares CEO pay with the average for all rank-and-file

employees in the U.S., while the law calls for using the median of all employees

worldwide, including executives other than the CEO.

Others whofve calculated pay ratios, such as the AFL-CIO, didnft

differentiate worker pay by industry or include employee benefits in their math.

Bloomberg News did, which tended to make the ratios smaller. (The AFL-CIOfs

average CEO-to-worker multiple at big U.S. companies is 357. Bloombergfs average

ratio for Standard & Poorfs 500 companies is 204; the average of the top 100

companies on our

table is 495. That is, CEOs of the companies on that table averaged 495

times the income of nonsupervisory workers in their industries.) Therefs no

question that using industrywide averages as the denominators is not a perfect

substitute for the real pay ratios Dodd-Frank calls for. If youfre a fast-food

chain CEO who pays line workers well above minimum wage plus full health

benefits, your ratio would still have the same low denominator as the skinflint

chain that pays only the minimum.

Every company on the list was asked to comment on the ratio—and to provide

their own. Only one in the top 100 came up with a number: Wynn

Resorts (WYNN), which says its ratio is 251. gThe outdated

and incorrect figures being used, together with a flawed methodology, results in

a distortion that is insulting to our employees,h Hugh Burns, a spokesman for

Simon Property Group (SPG), said in an e-mail. (Simon Property is No. 3

on the Bloomberg list of the largest ratios, and CEO David Simonfs

$137.2 million in compensation for 2011 was 1,594 times what the average

gfunds, trust, and other financial vehiclesh worker is paid.) Noting that the

pay reported last year is contingent on years of future performance, Burns said,

gThe survey creates a completely misleading result that grossly overstates and

inaccurately portrays David Simonfs compensation and makes any comparison

meaningless.h

The SEC has yet to set a deadline for the rule that would make pay-ratio

disclosure mandatory. Commissioner Luis Aguilar, a Democrat, suggested publicly

in February that companies should voluntarily disclose their ratios until the

agency acts. The other four commissioners, including Chairman Mary Jo White, who

took office in April, declined to comment. Representative Bill Huizenga, a

Michigan Republican, has introduced language to repeal the disclosure

requirement. The ratio gdoesnft do anything other than play politics,h he said.

Peter Drucker, the celebrated management theorist, certainly thought the

CEO-to-rank-and-file multiple mattered. Starting with a 1977 article and until

his death in 2005, Drucker considered 25-to-1 or even 20-to-1 the appropriate

limit. Beyond that, he indicated, itfs bad for business. In his view,

excessively high multiples undermine teamwork and promote a winner-takes-all,

gdid-it-because-I-couldh culture thatfs poison to a companyfs long-term health.

gIfm not talking about the bitter feelings of the people on the plant floor,h

Drucker told a reporter in 2004. gTheyfre convinced that their bosses are crooks

anyway.h He meant the people in middle management who become gincredibly

disillusionedh by runaway CEO compensation. On big executive payouts that

coincide with layoffs, Drucker was unequivocal. That, he said, was gmorally

unforgivable.h

To view the Top CEO Pay Ratio chart, visit http://go.bloomberg.com/multimedia/ceo-pay-ratio/.